Learn how to build an operational data layer (ODL) to unlock siloed payment data to power modern applications.

Use cases: Payments, Modernization

Industries: Financial Services

Products and tools: MongoDB Atlas, MongoDB Enterprise Advanced, Atlas Clusters, MongoDB Change Streams, Atlas Search, Atlas Charts, Atlas Auditing and Enterprise Security, MongoDB Kafka Connector, Queryable Encryption, Time Series

Partners: Confluent (for integration with Apache Kafka), AWS (for cloud infrastructure and services)

Solution Overview

Today's payment industry changes quickly, and businesses are working to offer secure and easy-to-use payment solutions. This need is driven by factors like new regulations, customer expectations, and market competition. Financial services organizations can use MongoDB to modernize their payment systems.

This solution showcases how you can use MongoDB to build an ODL. You can deploy an ODL on top of legacy systems to modernize your architecture without the difficulty and risk that comes with fully replacing the legacy systems.

Modernizing Payment Systems

Several factors are pushing the modernization of payment systems:

Real-time payments: Customers and businesses expect payments to be processed immediately.

Regulatory changes: New laws and regulations, like PSD2 in Europe, encourage more open and flexible payment systems.

Customer expectations: People want payment processes to be smooth and integrated across different platforms.

Open banking: Open banking makes the financial sector more competitive and innovative, allowing for the development of new payment services.

Competition: Fintech startups offer new payment solutions, challenging traditional financial institutions to update their systems.

Modernization Challenges

Updating payment systems is challenging due to:

Complex systems: Payment systems involve many different parties and regulations, making changes complicated.

Old technology: Outdated systems slow down innovation and make it difficult to meet current standards.

High costs: Upgrading old systems can be expensive and time-consuming.

Technical debt: Previous shortcuts in system design can limit future growth and adaptability.

In this example solution, you can learn how you can use MongoDB to modernize payment systems.

Approaches to Modernization

Businesses are embracing the following strategies when updating their systems:

Domain-driven design: By aligning system development with business needs, domain-driven design ensures that technology changes serve business goals.

Microservices architecture: By transitioning from a monolithic architecture to a microservices architecture, you can update and scale your system more efficiently.

How MongoDB Supports Modernization

The following MongoDB features support payment modernization efforts:

Flexible document model: MongoDB's document model allows you to incorporate new payment types and data structures, ensuring that your system can evolve with the market.

Operational data layer: MongoDB introduces a unified data layer that simplifies access to data across various services, which is crucial for building integrated payment solutions.

Support for best practices: MongoDB equips businesses with the tools they need to follow industry best practices, such as secure transactions and real-time analytics.

Reference Architectures

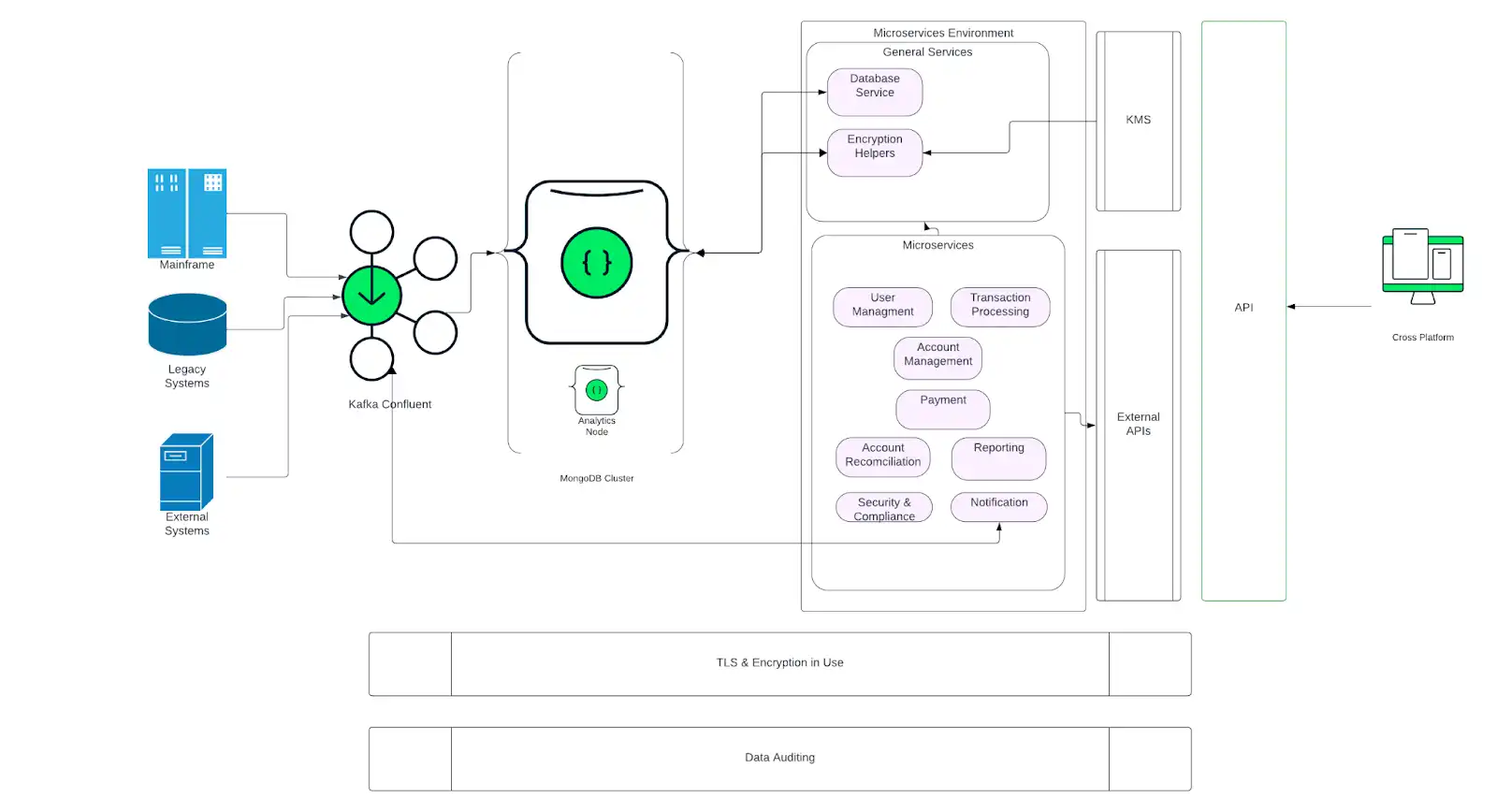

The diagram below details the architecture used by this payment solution. To learn more about how it works with MongoDB, visit our Real-Time Payments page.

Figure 1. Payments solution architecture diagram

Data Model Approach

This solution focuses on the relationships between entities like User Accounts, Transactions, Bank Accounts, and Payment Methods. It includes data attributes and detailed information for each entity.

Microservices Architecture

A microservices architecture breaks large monolithic applications into smaller pieces. It allows for faster development, modularity, flexibility and scalability, resilience, organizational alignment, and reduction in cost.

The microservices architecture used in this solution is broken into the following services:

User Management

Transaction Processing

Transaction History

Account Reconciliation

Payment Verification

Reporting

Notifications

User Management

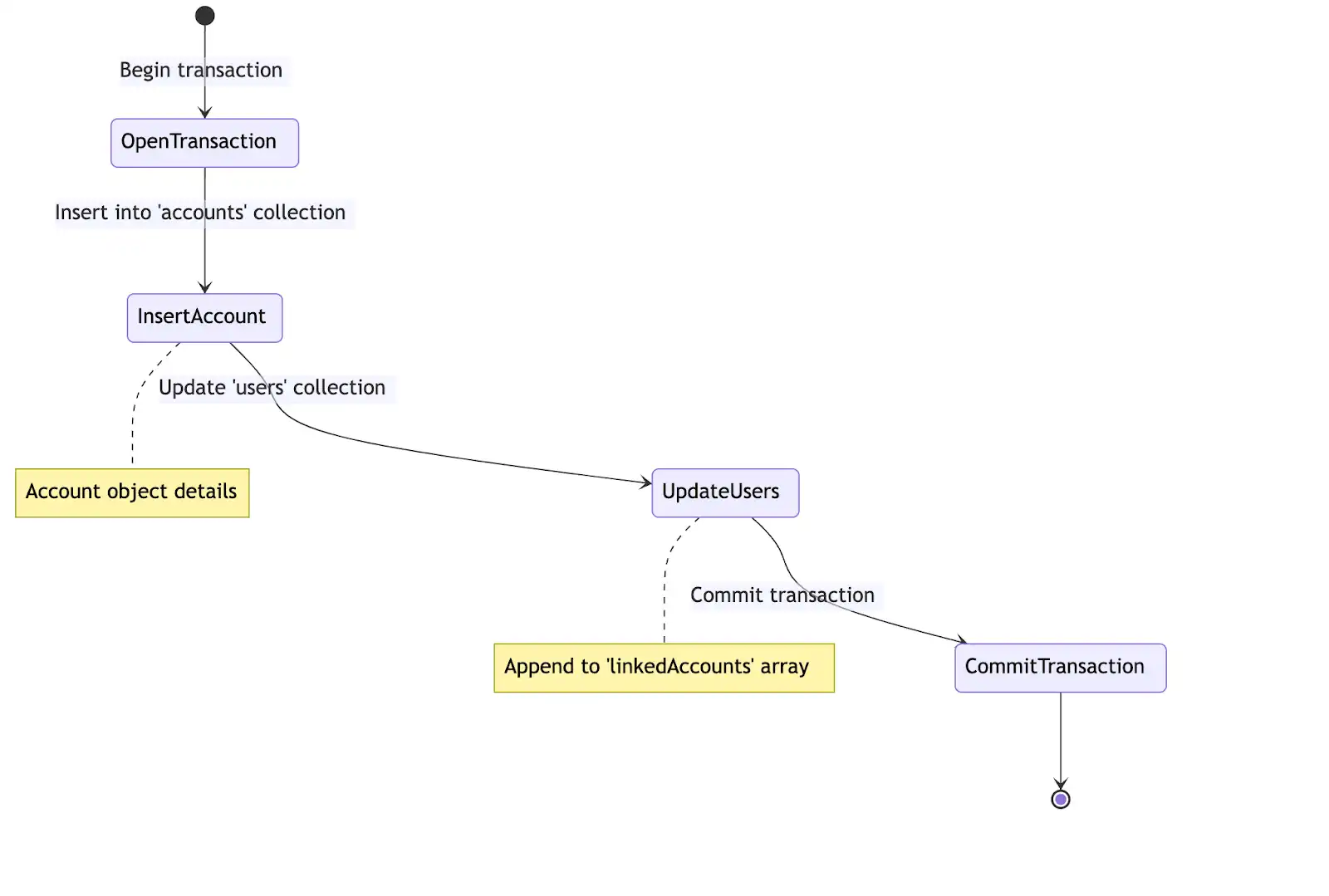

This service facilitates user and account interactions. The diagram below shows the flow for account creation.

The diagram involves the following entities:

Data entities: User Account, Payment Method, Bank Account

Permissions: Read/Write on User Account, Payment Method, and Bank Account

Inputs: User details, Payment method details, Bank account details

Outputs: User account creation confirmation, Payment method addition confirmation, Bank account addition confirmation

Figure 2. Account creation flow

You can see an application of this flow in this GitHub repository.

Transaction Processing

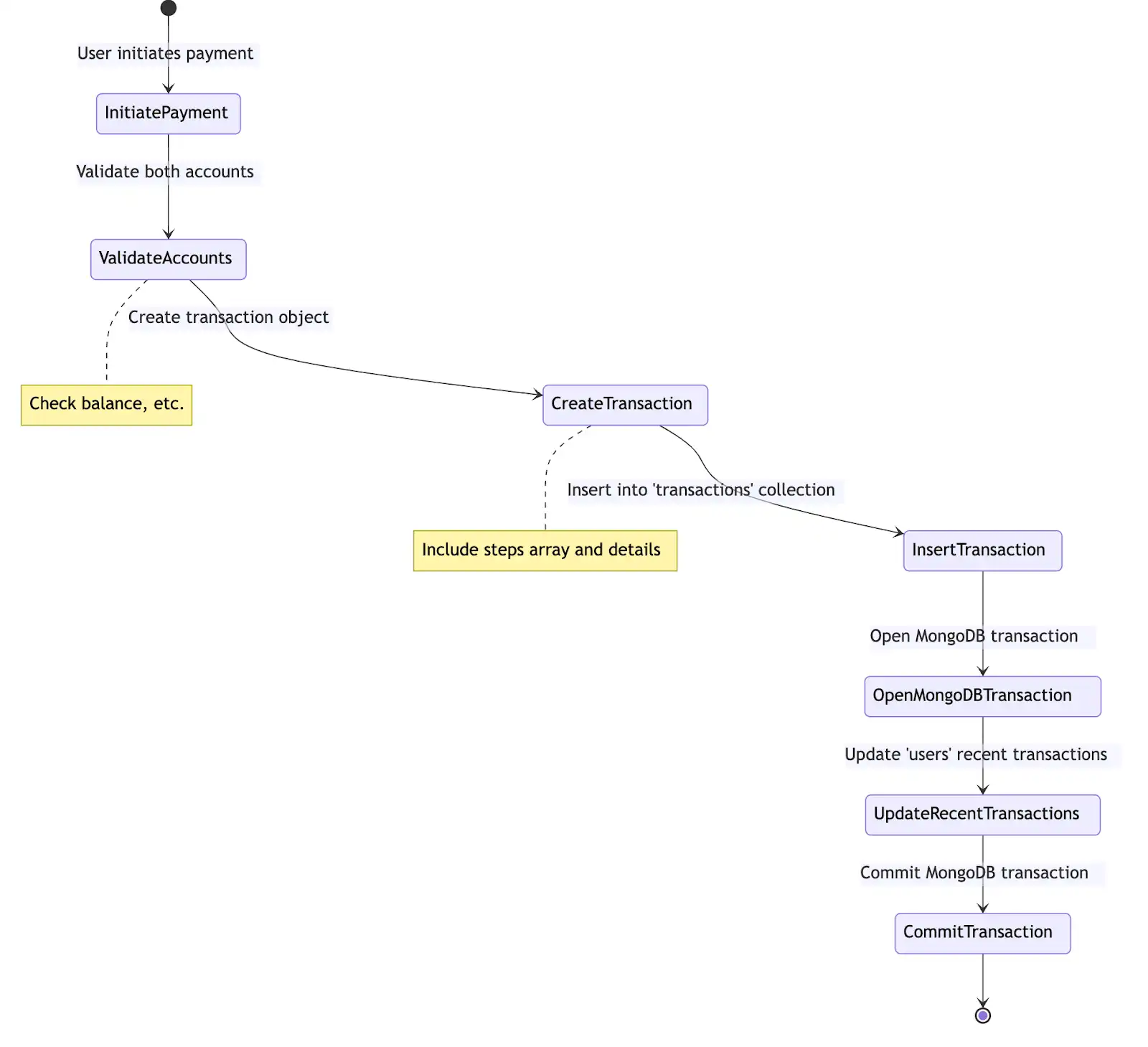

This service manages transaction-related operations, such as initiating, completing, or refunding a transaction. In the diagram below, you can see the main flow for initiating a transaction.

This diagram involves the following entities:

Data entities: Transaction, Bank Account

Permissions: Read/Write on Transaction, Read on Bank Account

Inputs: Transaction details, like amount, sender, and receiver

Outputs: Transaction status update, like pending, completed, or failed

You can see an application of this flow in this GitHub repository.

Figure 3. Transaction flow

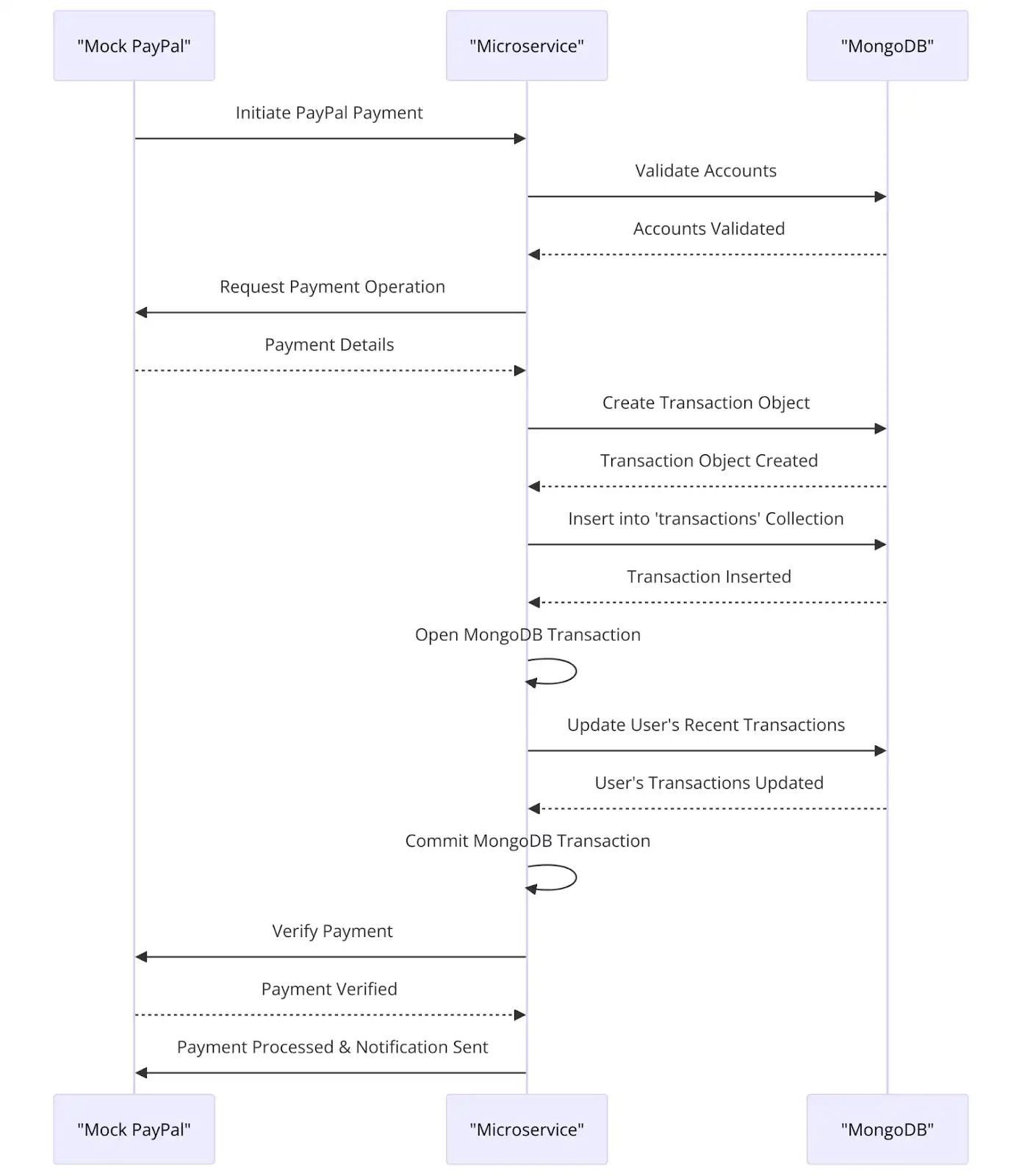

This microservice is also responsible for managing external provider transactions. For example, the solution includes a demo of a user getting a PayPal payment. MongoDB's flexible schema allows for variation in the documents that represent transactions.

The diagram below shows the process for the mock PayPal transaction.

Figure 4. External transaction flow

Transaction History

This service deals with transaction logging and archival. It involves the following entities:

Data Entities: Transaction History, User Account

Permissions: Read on Transaction History, Read on User Account

Inputs: User account number

Outputs: Transaction history data

You can see an application of these entities in this GitHub repository.

Account Reconciliation

This services verifies that the account details are up-to-date. It involves the following entities:

Data entities: Bank Account, Transaction

Permissions: Read/Write on Bank Account, Read on Transaction

Inputs: Transaction details, Bank account details

Outputs: Reconciliation status, Adjusted account balances

You can see an application of these entities in this GitHub repository.

Payment Verification

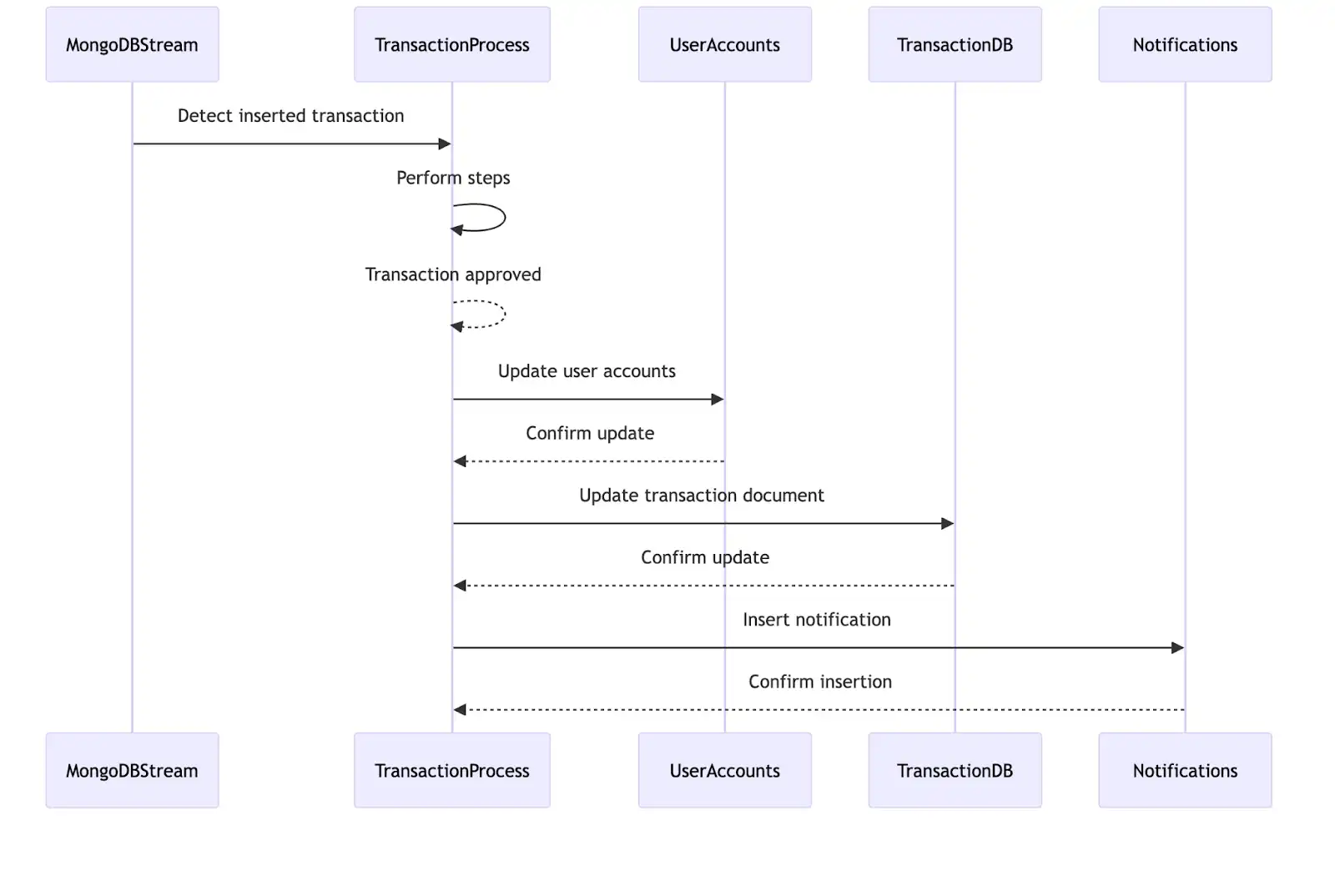

This service processes a transaction initiation. The diagram below shows the payment-processing steps, starting from when the service reacts to a payment and ending when it notifies the user about whether the payment was approved or rejected.

This service involves the following entities:

Data entities: Transaction, User Account, Bank Account

Permissions: Read on Transaction, Read on User Account, Read on Bank Account

Inputs: Transaction details, User account number, Bank account details

Outputs: Verification status (success or failure)

Figure 5. Payment processing flow

You can see an application of these entities in this GitHub repository.

Reporting

To create a view of your payment data, you can use MongoDB Charts.

This involves the following entities:

Data entities: Transaction History, User Account

Permissions: Read on Transaction History, Read on User Account

Inputs: User account number, Report criteria (date range, transaction type)

Outputs: Generated financial reports

Notifications

This services uses MongoDB Change Streams to notify the user of any changes.

This involves the following entities:

Data entities: User Account, Transaction

Permissions: Read on User Account, Read on Transaction

Inputs: User account details, Transaction details

Outputs: Notifications and alerts to users

You can see an application of these entities in this GitHub repository.

Database Schema and Document Structures

The following document structures and microservices form the backbone of the MongoDB-based payment solution, ensuring scalability, security, and efficient data management.

Users

Documents in the users collection have the following structure:

{ "_id": ObjectId, "username": String, "email": String, "password": String, // hashed "linkedAccounts": [ { "accountId": String, "accountType": String, "externalDetails": { "apiEndpoint": String, "accessKey": String, "additionalInfo": String } } ], "recentTransactions": [ { "transactionId": String, "date": Date, "amount": Number, "type": String, // e.g., 'debit', 'credit' "status": String // e.g., 'completed', 'pending' } ] }

Accounts

Documents in the accounts collection have the following structure:

{ "_id": ObjectId, "userId": ObjectId, "accountNumber": String, // Encrypted "accountType": String, "balance": Number, "limitations": { "withdrawalLimit": Number, "transferLimit": Number, "otherLimitations": String }, "securityTags": [String], "encryptedDetails": String }

Transactions

Documents in the transactions collection have the following structure:

{ "_id": ObjectId, "account_id": ObjectId, "amount": Number, "date": Date, "type": String, // e.g., 'debit', 'credit' "status": String, // e.g., 'completed', 'pending', 'refund' "details": String, // Encrypted if sensitive "referenceData": { "sender": { ... }, "receiver": { ... }, "steps": [{ ... }], "relatedTransactions": [{ ... }], "notes": String, "reportingTags": [String] } }

Notifications

Documents in the notifications collection have the following structure:

{ "_id": ObjectId, "relatedEntityId": ObjectId, "userIds": [ObjectId], "message": String, "createdAt": Date, "statuses": [ { "userId": ObjectId, "status": String // e.g., 'unread', 'read' } ] }

Build the Solution

The code for this tutorial can be found in this GitHub repository. To get

started, follow the README instructions.

The tutorial uses the following features in the different services:

Cross Microservices

Indexing and scalability

JSON schema validation

Permission and data segregation

Auditing

User and Account Microservices

Document model: Use MongoDB's flexibility to create user and account structures for different accounts and user profiles.

Kafka Sink Connector: Stream data from external sources.

Transactions: Keep account and user data ACID-compliant.

In-use encryption: Protect your data throughout its lifecycle.

Full-text search: Search for account IDs and usernames.

Payments Microservices

Change streams: Payments are event-driven.

Time series collections: Use a time series collection to hold payment history.

In-use encryption: Protect your data throughout its lifecycle.

Notification Microservices

Apache Kafka source: Use Kafka to stream notifications to external systems and users.

Change streams: Change streams capture notifications, which are then pushed by Websockets.

Reports

Atlas Charts: Use Atlas Charts to preprocess and visualize your data.

Key Learnings

If you use this solution, account for the following considerations:

Security and compliance: Adhere to GDPR, PCI DSS, and other financial regulations.

Scalability and performance: Ensure efficient query processing and data handling.

Audit and logging: Comprehensive logging for payments to support audits.

Backup and recovery: Robust plan for data recovery using MongoDB Atlas.

Authors

Pavel Duchovny, Developer Relations, MongoDB

Shiv Pullepu, Industry Solutions, MongoDB

Raj Jain, Solutions Architect, MongoDB

Jack Yallop, Industry Marketing, MongoDB