Driven by rising customer expectations and the demand for greater efficiency, accuracy, and agility, the financial services industry is undergoing a profound transformation. Gone are the days of painstaking manual document reviews, and welcome instead to the era of agentic AI, where intelligent systems and a robust data foundation redefine how financial data is processed and understood. Powered by MongoDB’s flexible, scalable platform, organizations can seamlessly manage multimodal data to unlock insights, automate workflows, and stay ahead in this evolving landscape.

The shift towards the agentic AI era is more than a technological milestone. A global survey conducted by Capgemini Research Institute of 1,100 leaders at organizations with more than $1 billion in annual revenue found that 93% are exploring or enabling gen AI capabilities, with adoption predicted to surge from 6% in 2023 to 30% in 2025. AI agents are gaining traction, with 14% of organizations implementing them and an additional 23% running pilots. Nearly 45% of organizations scaling AI agents are piloting or scaling multi-agent systems, validating AI's outcome into operational excellence.

By leveraging MongoDB's flexible document model and MongoDB Atlas Vector Search with retrieval-augmented generation (RAG) and agentic AI, financial service companies can capitalize on this momentum. Doing so can help them unlock actionable insights from raw documents, eliminate exhaustive manual workflows, and free teams to innovate and to enhance their offerings.

The rise of agentic AI in FSI

Agentic AI goes beyond traditional reactive models, delivering autonomous, proactive, and multi-step reasoning. It can analyze vast volumes of financial documents, understand context, uncover relationships, and initiate follow-up actions, making it a perfect fit for document-heavy workflows in FSI.

For agentic AI to reach its full potential, it needs a data infrastructure that can seamlessly handle large-scale ingestion, storage, and processing of diverse document types. That’s where MongoDB comes in.

MongoDB: The foundation for agentic AI document intelligence

MongoDB is a flexible, scalable, and developer-friendly platform, making it the ideal choice for building document intelligence workflows. Its ability to handle diverse, unstructured data provides a solid foundation for agentic AI solutions.

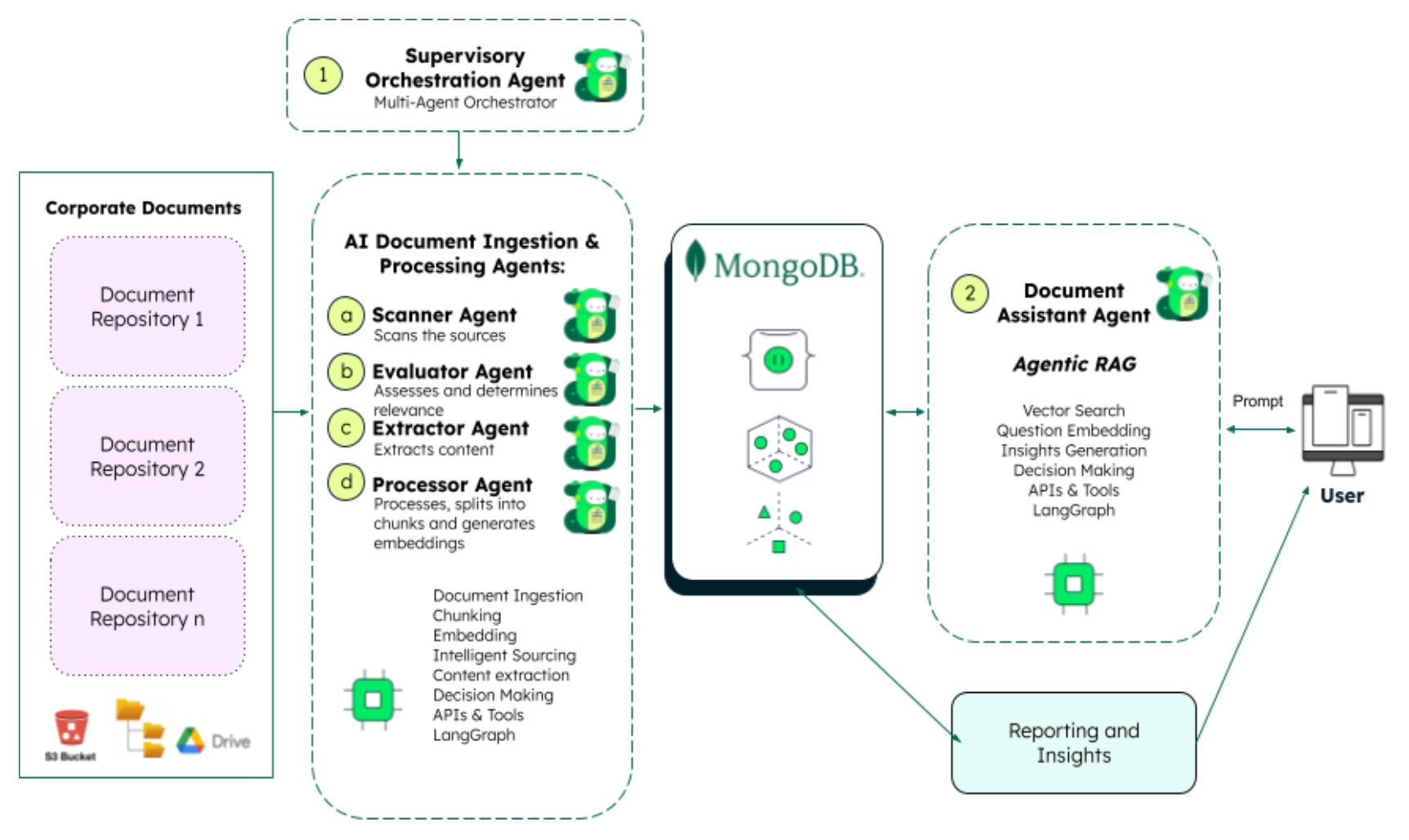

At the heart of this solution is MongoDB, streamlining complex workflows and enabling efficient data processing. As seen in figure 1, it starts with document sources, such as cloud repositories, local files, or other systems containing structured, semi-structured, or unstructured data. A multi-agent system then powers intelligent document processing, collaboratively scanning, analyzing, and transforming the data into actionable insights.

Agents in this solution

This solution consists of a supervisor multi-agent collaboration responsible for the intelligent document ingestion and processing*:

Supervisor agent*: This first agent is in charge of overseeing the overall system, setting goals, and delegating tasks to the lower-level agents. As seen in the rectangle below this orchestration agent, there are four “child” agents:

Scanner agent: Searches and identifies relevant sources or documents for processing.

Evaluator agent: Reviews and scores documents based on their relevance to the use case.

Extractor agent: Extracts the content from all pages of the documents that passed the assessment and are relevant to the use case, converts it into markdown format, and prepares it for chunking and embedding.

Processor agent: Organizes and processes extracted content, splitting it into chunks and generating embeddings for downstream tasks.

Document assistant agent: In the second part of the solution, an agentic RAG process is carried out and executed by a prompt-interaction agent. This agent decides whether to execute a function call to retrieve documents based on the user query and grading.

Tip

A supervisor multi-agent architecture is a type of multi-agent system in which multiple specialized agents operate under the coordination of a central supervisor agent that manages their interactions and orchestrates the overall control flow of the application.

Key AI capabilities of this solution

Agentic RAG

Traditional RAG improves the response generation process, by using information from a knowledge base. RAG follows a simple pattern, retrieving documents and generating an answer. Combining the power behind retrieval-augmented-generation (RAG) and agentic AI, provides a next-level approach to work with data in the organization. Retrieval agents are AI agents that have the power to decide when and how to retrieve and use data.

In agentic RAG, an agent can make the decision to retrieve context from a vector store in MongoDB and respond to the user directly. The knowledge base consists of all the documents contained in S3 buckets, Google Drive, or local files, and the Document Assistant Agent has the power to:

Decide to retrieve or skip data retrieval if it already knows the answer.

Perform multiple retrievals if needed.

Reformulate queries by refining search terms based on initial results.

Evaluate the quality of the retrieved documents before generating an answer.

Route intelligently, choosing between different data sources or retrieval strategies (tools).

Using agentic RAG leads to more accurate and contextually more contextually-relevant answers.

Contextualized chunk embeddings and Atlas Vector Search

MongoDB stores vector representations (embeddings) directly alongside the data, making it an all-in-one database for both native and semantic queries. With Atlas Vector Search, you can run semantic search over the ingested content, improving retrieval relevance and context awareness.

For greater accuracy, this solution leverages the embedding and reranker model of voyage-context-3. This embedding model stands out for its ability to generate contextualized chunk embeddings that smartly capture both detailed chunk-level information and the global document context—without requiring manual augmentation. The result is significantly higher retrieval accuracy paired with better cost efficiency.

Agent memory

Agent memory is what allows agents to remember and build on previous interactions, resulting in more intelligent, context-aware agentic systems that learn and improve over time. MongoDB enables long-term memory persistence for AI agents with ‘checkpoint collections’, allowing them to retain context across multiple interactions. MongoDB and LangGraph enable agents to accumulate knowledge and context over time for short and long-term memory.

Document intelligence FSI use cases empowered by MongoDB

Let's delve into some important document intelligence use cases within the financial services. The following scenarios demonstrate how agentic AI, powered by MongoDB, is revolutionizing document intelligence in the financial services industry.

1. Company credit rating

Challenge: Evaluating a company’s creditworthiness involves analyzing massive amounts of data from multiple sources and continuously monitoring changing market and economic conditions. Today, much of this process remains manual and time-consuming, and the resulting complexity and fragmentation often lead to delays that hinder effective risk management and strategic planning.

Input documents: Credit rating reports, rating outlook updates, watchlist notices, sovereign and corporate default studies, market and economic research publications, press releases, commentaries, and rating methodology documents from rating agencies.

MongoDB + agentic AI solution: Faster, more accurate, and more comprehensive credit assessments, reduced manual research time, enhanced risk management, and deeper market insights.

2. Exception handling in payment processing

Challenge: Payment exceptions arise due to reconciliation mismatches, communication gaps, and time-intensive investigation processes. These inefficiencies contribute to costly delays, customer dissatisfaction, and increased exposure to compliance risks.

Input documents: Payment investigation tickets, reconciliation reports, customer emails, bank correspondence, and dispute reports.

MongoDB + agentic AI solution: Reduced operational costs, faster resolution times, improved customer experience, increased payment processing accuracy, and better compliance.

3. Investment research

Challenge: Investment analysts are loaded with financial data across multiple sources, making it difficult to isolate pivotal insights and produce actionable recommendations efficiently. The manual curation of insights slows decision-making and limits market coverage.

Input documents: Analyst reports, market commentary, earnings call transcripts, financial statements, and sector research reports

MongoDB + agentic AI solution: Significant time savings for analysts, faster decision-making, improved quality of investment research, and better coverage of the market.

4. Client onboarding KYC

Challenge: Reviewing and validating diverse formats of client-submitted documents during the onboarding process is time-consuming and prone to bottlenecks, especially in compliance-heavy industries. These delays lead to operational inefficiencies and heightened fraud detection challenges.

Input documents: Client applications, identity verification, proof of address, and corporate registration documents.

MongoDB + agentic AI solution: Significantly faster client onboarding, reduced manual effort and operational costs, enhanced fraud detection, improved regulatory compliance, and better client experience.

5. Loan origination

Challenge: Loan origination workflows are weighed down by extensive documentation requirements, making underwriting a slow and costly process. The manual handling of documents increases the likelihood of errors and slows approvals, affecting risk and borrower experience.

Input documents: Loan applications, credit reports, tax statements, income verification, appraisals, and legal agreements.

MongoDB + agentic AI solution: Faster loan approval times, reduced operational costs, improved accuracy and consistency in underwriting, enhanced risk management, and better borrower experience.

Agentic AI + MongoDB: A winning combination in FSI

The financial services industry is at an inflection point. The traditional, manual processes for handling financial documents are no longer sustainable in an increasingly complex and regulated environment. Agentic AI, with its ability to understand, reason, and act autonomously, offers a transformative solution. By leveraging the power of MongoDB as the foundational data platform providing unmatched flexibility, scalability, and performance for diverse document types, financial institutions can unlock the full potential of agentic AI document intelligence.

From revolutionizing investment research and loan origination to streamlining KYC onboarding and regulatory compliance, the combination of agentic AI and MongoDB is not just an incremental improvement; it is a fundamental shift that promises to drive unprecedented levels of efficiency, accuracy, and innovation. The future of financial services is intelligent, autonomous, and powered by data.

Next Steps

Learn how to build a smart investment portfolio with agentic AI, MongoDB Atlas, Vector Search, and Charts.

Learn more about AI agents in this blog.