For the past several years, banks and financial services institutions have accelerated their adoption of digital asset technologies. This push is driven by market momentum and supportive regulatory shifts. According to an EY survey¹ 59% of institutional investors plan to allocate over 5% of their assets under management (AUM) to cryptocurrencies this year. U.S. respondents and hedge funds lead this trend.

An Elliptic report² highlights that 44% of financial institutions are ready to offer bank accounts to crypto businesses. Another 21% are already actively engaged in digital assets. Chainalysis data³ further underscores this surge, showing that in 2025 North American on-chain crypto activity frequently exceeds $2 trillion in monthly transfer volumes, reflecting deep institutional enthusiasm. These statistics paint a clear picture that digital assets are becoming mainstream. Financial institutions need robust, scalable infrastructure to handle the required complexity, volume, and resiliency.

Regulators are also taking action. In 2025, U.S. regulatory work is providing more direction for stablecoins and digital-asset frameworks. Examples include GENIUS/CLARITY style efforts and the SEC/CFTC's focus on classification and consumer protection. This new landscape creates clear requirements for digital asset offerings, auditability, custody controls, transaction provenance, and robust KYC/AML capabilities.

Why MongoDB is a natural fit for digital assets

As U.S. banks and financial institutions accelerate their journey into the world of digital assets, the demand for a flexible, high-performance data foundation has never been greater.

MongoDB offers financial institutions a complete solution. It can handle the complex requirements of blockchain-integrated systems, crypto transactions, and tokenized asset platforms—all of which empowers institutions to innovate securely and at scale.

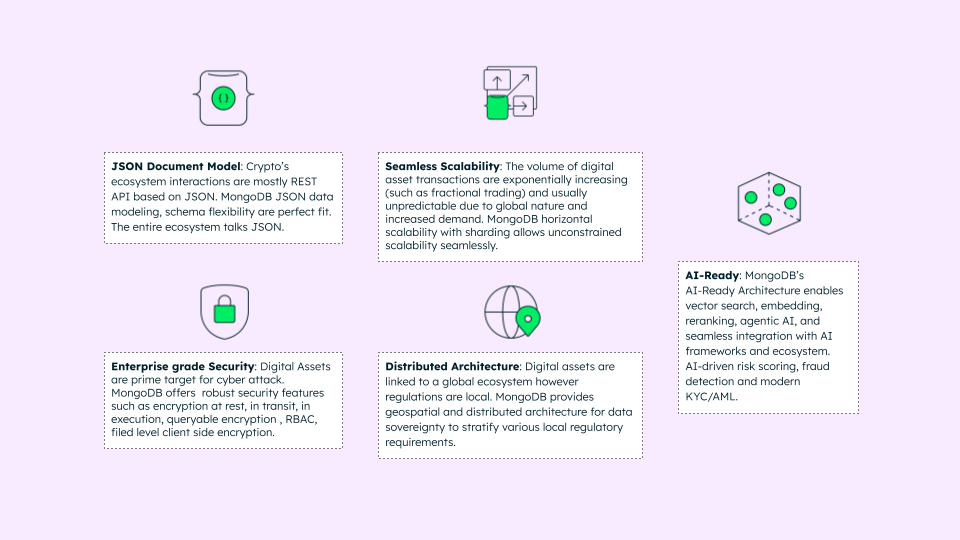

Figure 1. Why MongoDB for digital assets?

Let’s take a closer look at some of the key capabilities that make MongoDB an ideal choice for digital assets:

1. Document model for diverse crypto data types

Digital assets require storing heterogeneous records, such as:

- Token metadata

- On-chain references

- Business attributes

- KYC/beneficial-owner structures

- Off-chain attestations

- And changing lifecycle states

MongoDB’s flexible document model lets you store diverse crypto assets like BTC, ETH, tokenized bonds, and NFTs all in a single collection, even with varying metadata structures. Each token can include subdocuments for wallets, transactions, and audit trails—without the need for complex joins.

2. Scalability for high-volume transactions

The crypto world is volatile, with spikes in trading volume that can overwhelm systems. MongoDB Atlas, the cloud-managed service, excels in horizontal scaling. It allows financial services institutions to handle billions of transactions without downtime.

Cryptocurrency exchanges face highly volatile and unpredictable traffic, making scalability and reliability critical. Coinbase, one of the largest crypto exchanges in the United States, uses MongoDB Atlas for predictive scaling to improve user experience and dramatically reduce scaling time. Similarly, Seracle relies on MongoDB to build its blockchain service and crypto exchange, ensuring it can handle the demands of the dynamic crypto market.

3. Robust security and compliance

With regulations emphasizing risk management, MongoDB offers enterprise-grade security, including encryption at rest, role-based access control, and audit logging. Banks need encryption at rest, TLS in transit, customer-managed key support. They also need the ability to keep certain fields encrypted so even DB operators cannot see them. This is enabled by Client-Side Field Level Encryption (CSFLE) and queryable encryption for selective in-use encryption. With MongoDB Queryable encryption, sensitive wallet owner data or KYC info can stay encrypted while remaining searchable.

4. Global distribution & ecosystem integration

Modern digital asset services require multi-region availability, low read latency (wallet UX), and operational controls for compliance. Atlas (MongoDB’s managed cloud) offers global clusters, automated backups, point-in-time restore, and fine-grained access controls — letting banks reduce ops overhead while meeting SLAs. For regulated banks, multi-region availability ensures compliance with data residency /sovereignty (e.g., U.S., EU).

The majority of APIs in the digital assets ecosystem communicate via JSON data format. MongoDB as a native JSON database enables ease of integration and interoperability with the entire crypto ecosystem.

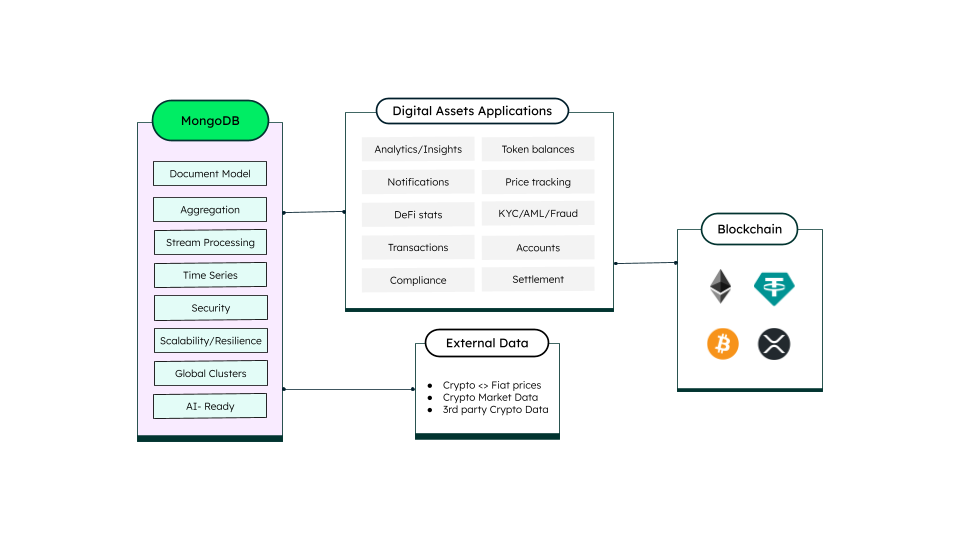

MongoDB enables off-chain data layer

MongoDB serves as the off-chain data layer in the crypto ecosystem, bridging the gap between immutable blockchain networks and dynamic, data-driven applications. While blockchains handle consensus and settlement, MongoDB enables real-time off-chain data storage, enrichment, and analytics powering wallets, exchanges, custodians, and compliance systems with fast, flexible access to transactional and contextual data.

MongoDB transforms off-chain data into intelligence. It correlates wallet behavior, transaction patterns, and market signals for compliance, fraud detection, and AI-driven insights. In short, MongoDB is the operational backbone that makes crypto’s off-chain world intelligent, compliant, and enterprise-ready. This is crucial for off-chain data management in blockchain ecosystems, where MongoDB serves as a complementary layer to on-chain ledgers.

Figure 2. MongoDB off-chain data enablement.

MongoDB’s role in digital asset custody

Digital asset custody involves intricate data management across wallets, blockchains, and regulatory requirements. MongoDB’s capabilities are uniquely suited to address these challenges by enabling secure, scalable, and flexible solutions for custodians.

- Wallet and account management: Custodians manage millions of wallets both hot and cold. Each wallet has dynamic metadata: balances, asset types, addresses, custody type, user permissions, whitelists, etc. MongoDB nested JSON document model allows storing all these attributes in one place adapting as new asset types (tokenized securities, stablecoins, NFTs) emerge.

- Multi-asset and multi-chain support: Custody platforms support multiple coins Bitcoin, Ethereum, Solana, tokenized assets, etc. Each chain has different data structures. MongoDB schema flexibility allows modeling each without redesigning tables. Adding a new asset or blockchain requires no schema migration.

- Audit, compliance, and regulatory reporting: Custodians must maintain immutable audit trails and provide real-time compliance views. MongoDB Geospatial and immutable event logs (via Append-Only design) track all changes to wallet states and transactions. With Atlas Search or Vector Search, you can implement AML pattern detection or wallet behavior similarity analysis.

- Key management metadata: Actual private keys stay in HSMs (Hardware Security Module) or MPC (Multi-Party Computation) systems, but MongoDB stores metadata, access policies, key versions, rotation logs, and signer states. This metadata is critical for operational governance and ensuring no unauthorized signing occurs.

- Resilient, multi-region deployment: Custody systems are mission-critical — no downtime allowed. MongoDB’s multi-region replica sets and encryption at rest/in transit ensure both availability and data sovereignty compliance (e.g., GDPR, FINMA, or MAS rules).

Figure 3. How MongoDB empowers digital assets custody.

The bottom line

Financial institutions plan to materially increase their digital asset activity. Simultaneously, the regulatory environment is evolving rapidly and regulators demand secure, defensible, auditable platforms. That creates a unique requirement set for flexible data models, real-time data and strong security posture.

MongoDB maps to all of these needs. It accelerates developer time-to-market for constantly changing digital assets landscape to empower tokenization and wallet services. It also supports real-time compliance and monitoring workflows, and provides security and operational controls that align with emerging regulatory expectations.

MongoDB is a perfect fit for teams building custody, stablecoin rails, tokenized securities, or bridge services between on-chain and off-chain systems. It provides a production-ready, enterprise-grade data foundation for the digital asset platforms of tomorrow.

Next Steps

Explore how MongoDB enables the future of digital assets:

• Check out the first post in the digital assets series: Accelerating Stablecoin Innovation in US Banking, to learn more about MongoDB's impact on financial innovation.

• Next up: Stay tuned for our blog on Tokenization to complete the scope of how MongoDB empowers the digital assets landscape.

• Discover real-world applications: Learn how Coinbase scales to match volatile crypto traffic with MongoDB.

Follow the series to stay ahead in understanding how MongoDB is transforming the future of finance!

³ https://www.chainalysis.com/blog/north-america-crypto-adoption-2025/