Doing Banking Better by Serving Americans Overlooked by Traditional Banks

Current CEO Stuart Sopp knows a thing or two about banking and financial services. His background reads like a Who’s Who of the industry: Morgan Stanley, Citi, Deutsche Bank, and BNY Mellon. Despite Sopp’s depth of financial services expertise, he was determined to do banking even better. He founded Current with the belief that banking should be accessible and affordable for all. Current is now a leading U.S. challenger bank — using innovative approaches, services, and technologies — to serve Americans overlooked by traditional banks, regardless of age or income level, to help improve their financial outcomes.

Current CTO Trevor Marshall joined us for a conversation on how the company is working with MongoDB and Google Cloud to translate those lofty goals into decisive action that has the potential to stand the financial services industry on its head.

The Challenge

How to Break Through Legacy Systems and Mindsets to Create Amazing Customer Experiences

Traditional banks are account-driven, not people-driven. Want to keep individual accounts while opening a joint account? You may have to go through the entire account enrollment process again, being treated as if you were a completely new customer. For example, your checking, savings, and credit card accounts are often cannibalized by different teams inside a bank. What the credit card team wants you to do may be fundamentally different than what the lending and banking teams want you to do. The teams sell against each other to meet their individual team objectives. That can create confusion, not to mention overdrafts and other shortfalls, and increases the complexity of managing your most basic financial affairs

Unfortunately, legacy infrastructure locks this in by reinforcing and even creating data and organization silos. And none of this places the focus where it should be: simplifying customers’ lives and obtaining the best overall outcomes for them.

Current’s challenge was to break through walls of legacy thinking and technology to build bridges between the traditional financial world and a fully digital future, creating customer experiences that simply cannot exist in traditional systems. But it was even bigger than that. What Sopp, Marshall, and the team were contemplating was change on an order of magnitude that would shake (and reshape) the industry. It was very much like when the light flashed on, collectively, in the heads of the world’s communications service providers (CSPs): they stopped thinking in terms of “phone numbers” and started looking holistically at the customer. In an era of ubiquitous free or low-cost communications services from OTT (over-the-top) providers, this single view of the customer may be what helps CSPs survive.

Focusing on customers, not bank accounts, would differentiate Current from legacy banks and help it thrive.

Sopp and Marshall had worked closely together over many years across different projects and companies, so they knew they were up to the challenge. What they needed were equally capable partners to help implement their vision.

The Solution

A Modern Database to Drive a Transformational Approach to Banking

To implement that vision, Current built its own ledgering system: Current Core, a retail banking platform providing true ledger state back to each of its banks. Marshall determined that Current needed a modern database that offered the most scalable, efficient way to optimize the success of this new application.

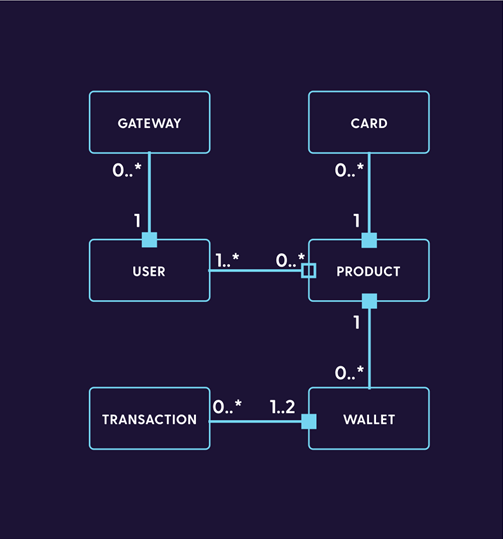

Current Core, illustrated in Figure 1, features event-driven architecture that collects every transaction event in a MongoDB collection. These events construct debits and credits on the customer's ledger. The platform translates ACH (automated clearing house, or direct withdrawals), mobile check deposits, cash deposits, peer-to-peer payments, ATM, point of sale (POS) debit card purchases, and all other transactions into events, and stores them in a ledger that lives inside MongoDB. “By collapsing a collection of events, you can derive the current state of the user. This has enabled Current to usher in an era of a truly customer-focused, not legacy bank account-focused, financial services,” said Marshall.

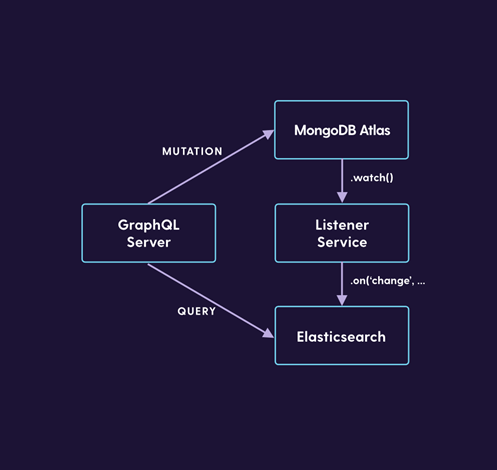

MongoDB Atlas Search adds search right on top of the data stored in Current Core without all of the overhead, such as another layer of synchronization, that would have been required to integrate a separate search engine like Elasticsearch, as illustrated in Figure 2.

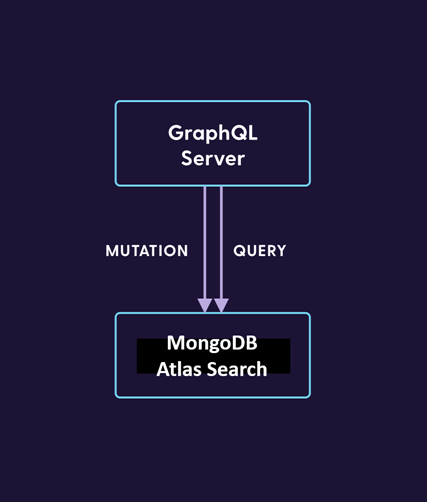

The updated architecture, as illustrated in Figure 3, uses Atlas Search to simplify queries and enhance accuracy, while enabling other services such as user-to-user payments.

Marshall, who has used MongoDB in previous roles since 2015, said Current chose MongoDB for its:

- Strongly consistent data model

- Enterprise security with Field Level Encryption to address security, audit, and compliance requirements

- Multi-document distributed transactions with ACID guarantees to maintain transactional data integrity across the system

“MongoDB gave us the flexibility to be agile with our data design and iterate quickly. The primary driver was the development velocity,” said Marshall.

Current chose MongoDB Atlas on Google Cloud because it needed a VPC-peered connection with its Google Kubernetes Engine (GKE) clusters, he explained. “Scaling MongoDB, we didn’t want to manage it ourselves. We wanted to ensure that we were running the latest and greatest versions of the MongoDB server, and that we had a team we could work with for support and guidance.”

“Google Cloud has the most cohesive offering of best-in-class cloud technologies. The way the components talk to each other allows for quick implementation for many use cases,” said Marshall. “We came for the credits; we stayed for the Kubernetes.”

Current is also using MongoDB Compass to make Current Core more accessible to business users.. In addition to GKE, Current is using other Google Cloud solutions including Dataflow, PubSub, Memorystore, IAM + IAP, and Google BigQuery. Current also uses Neo4j, which handles data linkages and user householding to expedite some queries.

The Results

Great Customer Experiences, Lower TCO, 500% YoY Revenue Growth — and an Industry First

“By working with MongoDB and Google Cloud we are creating excellent customer experiences. Our company mission of creating better financial outcomes for people is reflected all the way down to the way data is stored in MongoDB. It is uncommon, especially in financial services, for the data model to support the business so directly,” said Marshall. “Current Core, our proprietary banking technology, makes this possible by providing greater stability, faster money, and cost efficiencies that we pass on to our community of members.”

“When you have your initial interaction with Current, we know you as a valued member instead of ‘knowing you’ as a string of siloed accounts,” he added. Using the data model to directly support the business helps Current offer an enhanced level of services and features to all customers, including:

- Paychecks paid up to two days faster through direct deposit

- Free overdraft up to $100 with its Overdrive TM feature

- No minimum account balance or hidden fees

- Reward points on purchases redeemable for cash back

- 24/7 customer support

Current uses location data from the phone in combination with the transaction data over the card network to improve attribution of rewards purchases. Current also supports multiple attribution options for merchants setting up campaigns on Current's merchant platform. For example, merchants have the flexibility to set up campaigns either to be always-on once the user adds the offer, or to require an activation in the app before each purchase.

Marshall said MongoDB Atlas has provided seamless performance and reliability as demand for Current Core has increased 30% week over week in some recent periods. “Atlas has enabled Current to reduce TCO by giving it the power to pushbutton-scale its platform as needed to meet changing demand with zero Ops intervention,” Marshall added. MongoDB’s flexible data also enables Current to release new services and features much faster than the competition — such as introducing the first point of sale rewards platform in the US that handles debit cards. Current members get another convenience feature and Current continues to expand its business.

Support, too, is key. “MongoDB Atlas has excellent support, and we’ve seen exceptional response times when needed,” said Marshall.

Not only does all of this position Current better in a competitive marketplace, it also yields deeper economic benefit to Current and its members. “Our ability to directly integrate with financial service providers allows us to achieve best-in-industry unit economics, and we pass that financial benefit right back to members,” said Marshall.

Innovating with MongoDB and Google Cloud is paying off in other ways: Current has doubled its member base in less than six months to surpass two million members and increased its revenue more than 500 percent year over year to firmly establish the challenger bank as an industry leader in the U.S. In late November 2020, Current announced it raised $131 million in Series C funding, bringing it to over $180 million in total funding to date, with a valuation of $750 million.

MongoDB and Google Cloud figure prominently in Current’s future plans. Marshall said Current plans to take advantage of MongoDB’s sharding and horizontal scaling, and to expand its use of Google Cloud services, including “a lot more Dataflow.”