Build secure, high-performance fintech applications with MongoDB and Hasura Data Delivery Network, featuring real-time data access and regulatory support.

Use cases: App Driven-Analytics, Fraud Prevention, Modernization, Payments, Personalization, Single View

Industries: Financial Services

Products and tools: MongoDB Atlas, MongoDB Atlas Vector Search, MongoDB Kafka Connector

Partners: Hasura

Solution Overview

In the rapidly transforming fintech sector, financial services providers require several application features that address evolving customer needs and meet the following requirements:

Process high-volume real-time transactions

Map complex data relationships across customer profiles, financial instruments, and privacy requirements

Meet regulatory compliance requirements with geographical data residency constraints

Adapt to volume spikes and new product offerings with scalable systems

Provide real-time analytics for risk assessment and fraud detection

To address these challenges, this solution uses Hasura and MongoDB to build a modern fintech application with the following tools:

Hasura Data Delivery Network: Hasura DDN provides a data access layer for advanced applications and AI. You can use Hasura DDN to build and deploy a secure, federated API layer on your data.

MongoDB Atlas: MongoDB Atlas' document model, horizontal scalability through sharding, and performance optimizations provide security and reliability in your financial applications.

Reference Architectures

This reference architecture enables you to build fintech applications that handle high transaction volumes while maintaining data integrity, security, and regulatory compliance.

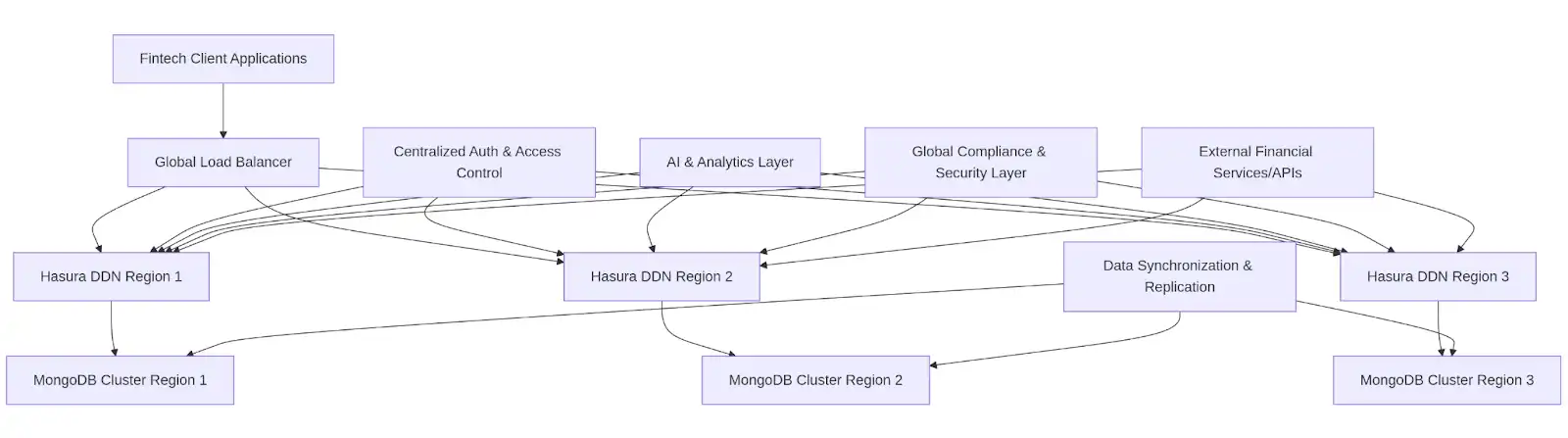

The following diagram shows the multi-regional deployment of Hasura DDN with MongoDB clusters:

Figure 1. Hasura DDN with MongoDB architecture diagram

In this diagram, client applications connect through a global load balancer to multiple Hasura DDN regions, which interact with MongoDB Atlas clusters across multiple geographic locations. The architecture also incorporates centralized authentication and access control, AI and analytics capabilities, global compliance, security measures, and integration with external financial services.

The following layers make up the key components of this solution's architecture:

Data layer: MongoDB Atlas clusters for primary data storage

API and access layer: Hasura DDN for data access and real-time subscriptions

Application layer: Fintech services and applications

Security layer: Authentication and authorization services

Analytics layer: Data processing and ML services

Data Model Approach

MongoDB's document-based structure addresses the unique requirements of financial applications. The flexible schema design allows organizations to adapt quickly to new financial products or regulatory requirements without disruptive schema migrations.

The following example shows a customer document with embedded account information:

{ "_id": ObjectId("5f8a7b2b9d3b2e5a7c8b4567"), "customerId": "C10045678", "customerInfo": { "name": "Jane Smith", "contactDetails": { "email": "jane.smith@example.com", "phone": "+1-555-123-4567", // PII fields can utilize MongoDB's field-level encryption }, "kycStatus": "verified", "riskProfile": "moderate" }, "accounts": [ { "accountId": "A200387645", "accountType": "savings", "balance": 45678.92, "currency": "USD", "status": "active", "createdDate": ISODate("2022-03-15T10:30:00Z") }, { "accountId": "A200456789", "accountType": "investment", "balance": 125000.00, "currency": "USD", "status": "active", "createdDate": ISODate("2022-08-22T14:45:00Z") } ] }

This example document demonstrates the following MongoDB capabilities:

Support sharding strategies for high-volume data by customer ID or date ranges for time-series transaction data

Provide storage optimization for performance

Grant role-based access control and field-level security

Build the Solution

This architecture focuses on security, performance, and scalability. The MongoDB data layer interacts with the Hasura DDN API layer while addressing authentication, security policies, and compliance requirements.

Deployment Strategy

Deploy this solution in multiple geographic regions to support global financial operations:

Configure MongoDB for high availability using replica sets.

Use appropriate sharding strategies based on financial data access patterns.

Position Hasura DDN instances close to their respective MongoDB clusters to minimize latency for real-time financial transactions and market data updates.

The centralized authentication and access control layer ensures consistent policy enforcement across all regions. The AI and analytics layer enables fraud detection and risk assessment.

Implementation Approach

Use an incremental approach when implementing this architecture:

Start with specific financial use cases like trading platforms or personalized banking.

Expand to cover more complex scenarios.

This solution accommodates new fintech startups building from scratch and established financial institutions transitioning from legacy systems through an API-first modernization approach.

Note

To learn how to implement anti-money laundering solutions using this architecture, see the Axiom repository.

While the API querying functionality works as documented, the Axiom repository does not cover the additional steps necessary to set up PromptQL locally. Use the PromptQL playground to test queries online.

Key Learnings

Distributed architecture improves performance: MongoDB's distributed clusters with Hasura DDN's regional deployment achieve microsecond-level latency for trading platforms and high-frequency transactions while maintaining data consistency globally.

Multi-layered security protects applications: A multi-layered strategy combines centralized and decentralized security. Hasura's permission systems and MongoDB's field-level security provide protection while maintaining flexibility for regulatory requirements like GDPR, PSD2, and MiFID II.

Flexible data models enable innovation: MongoDB's schema flexibility with Hasura's GraphQL API generation allows fintech organizations to deploy new offerings without extensive redevelopment.

Real-time capabilities enhance customer experiences: This architecture supports real-time data subscriptions and complex relationship mapping for personalized banking, fraud detection, and risk assessment using complete customer data views.

Incremental modernization reduces risk: The API-first approach allows organizations to transition from legacy systems by creating a modern data access layer while maintaining existing data sources.

Authors

Jon Mills, Hasura

Aditi Phadke, Hasura

Asawari Samant, Hasura

Adam Malone, Hasura

Kenneth Stott, Hasura

Sebastian Rojas Arbulu, MongoDB