Modernizing core banking systems with MongoDB can bring many benefits such as faster innovation, flexible deployment, and instant scalability. According to McKinsey & Company, it is critical for banks to modernize their core banking platforms with a “flexible back end” in order to stay competitive and adapt to new business models. With the emergence of better data infrastructure based on JSON and the ongoing evolution of software design, the next generation of composable core banking processes can be built on MongoDB's modern database, offering greater flexibility and adaptability than traditional systems.

The current market: Potential core banking solutions

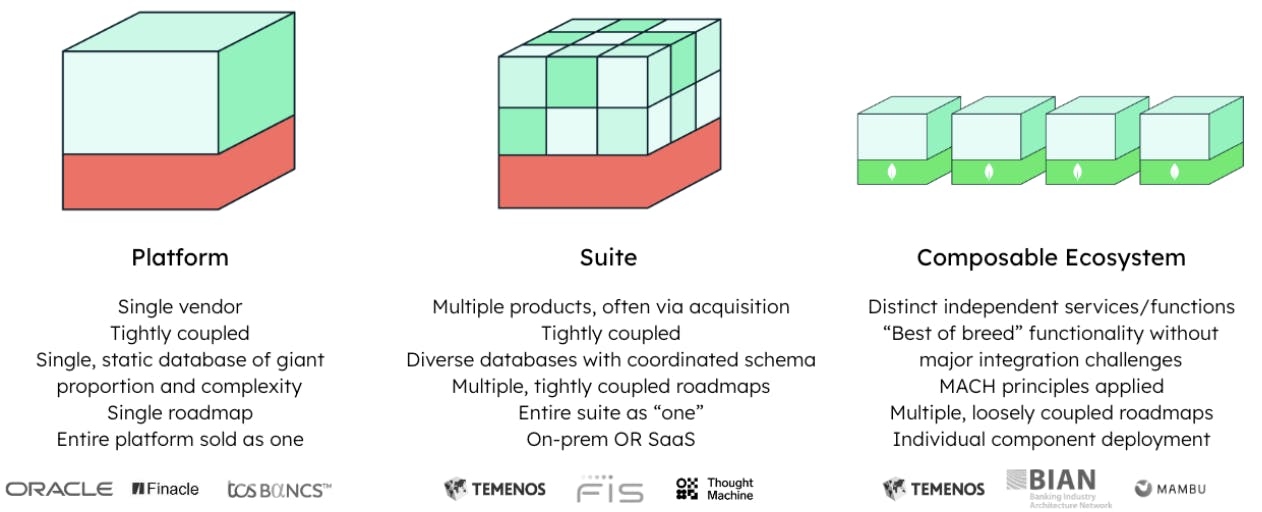

Financial disruptors such as fintechs and challenger banks are growing their businesses and attracting customers by building on process-centric core banking systems, while traditional banks struggle with inflexible, legacy systems. As seen in Figure 1 below, two potential solutions are the core banking “platform” and “suite”. The platform solution involves using a single vendor and several closely integrated modules. It also includes a single, large database and a single roadmap. On the other hand, the suite solutions refers to using multiple vendors, multiple loosely integrated modules, multiple databases and roadmaps. However, both of these systems are inflexible and result in vendor lock-in, preventing the adoption of best-of-breed functionalities from other vendors.

A new approach, known as a composable ecosystem as seen on the far right of Figure 1, is being adopted by some financial institutions. This approach consists of distinct independent services and functions, with the ability to incorporate "best of breed" functionality without major integration challenges, multiple loosely coupled roadmaps, and individual component deployment without vendor lock-in. This allows for specialization and the development of advanced individual components that can be combined to deliver the best products and services and is better at adopting new technologies and approaches.

Composable ecosystems with MongoDB's modern database

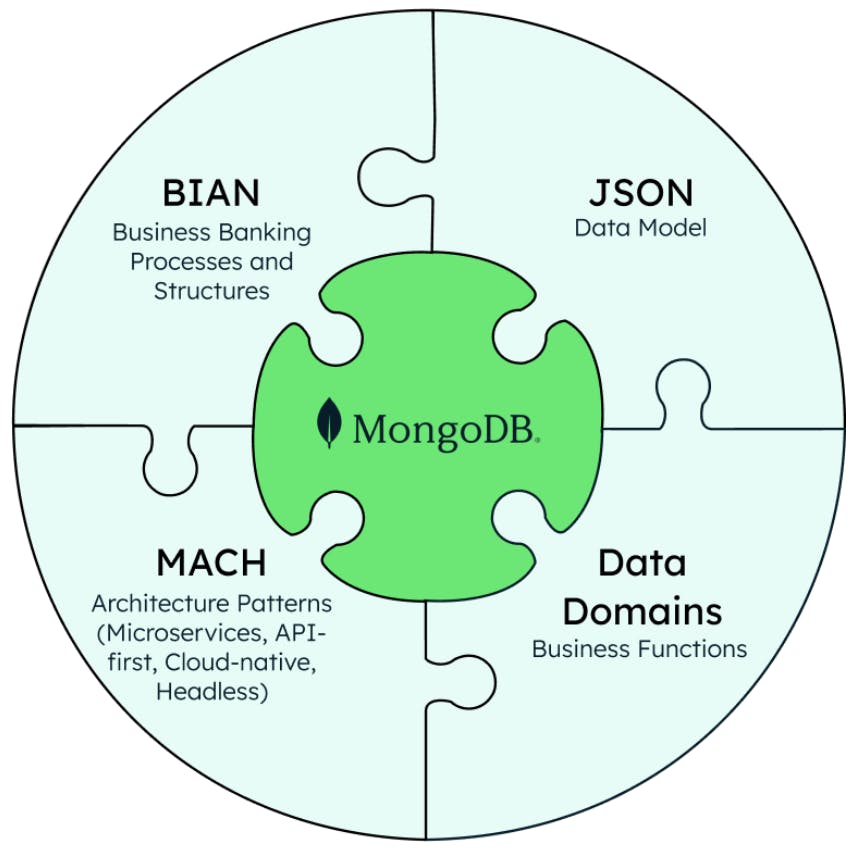

MongoDB’s modern database is the best choice for financial institutions to build a composable core banking ecosystem. Such an ecosystem is made up of four key building blocks as seen below in Figure 2: JSON, BIAN, MACH, and data domains. JSON is a widely-used data format in the financial industry, and MongoDB's BSON extension allows for the storage of additional data types. BIAN is a standard that defines a component business blueprint for banking, and MongoDB's technology supports BIAN and embodies MACH principles. MACH is a set of design principles for component-based architectures, and data domains enable the mapping of business capabilities to applications and data. By using MongoDB's modern database, financial institutions can implement flexible and scalable core banking systems that can adapt to the ever-changing market demands.

MongoDB in action: Core banking use cases

Companies such as Temenos and Current have utilized MongoDB's capabilities to deliver innovative services and improve performance. As Tony Coleman, CTO of Temenos, said, "Implementing a good data model is a great start. Implementing a great database technology that uses the data model correctly, is vital. MongoDB is a really great fit for banking." MongoDB and Temenos have worked on a number of new, component-based services to enhance the Temenos product family. Financial institutions can embed Temenos components to deliver new functionality in their existing on-premises environments or through a full banking-as-a-service experience with Temenos T365, powered by MongoDB on various cloud platforms. Temenos has a cloud-first, microservices-based infrastructure built with MongoDB, which gives customers flexibility while improving performance.

Current is a digital bank that was founded with the aim of providing its customers with a modern, convenient, and user-friendly banking experience. To achieve this, the company needed to build a robust, scalable, and flexible technology platform. Current decided to build its core technology ecosystem in-house, using MongoDB as the underlying database technology. "MongoDB gave us the flexibility to be agile with our data design and iterate quickly," said Trevor Marshall, CTO of Current. In addition, MongoDB's strong security features make it a secure choice for handling sensitive financial data. Overall, MongoDB's capabilities make it a powerful choice for driving innovation and simplifying landscapes in the financial sector.

Conclusion

In conclusion, the financial industry is in need of modernizing their core banking systems to stay competitive in the face of rising disruptors and new business models. A composable ecosystem, utilizing a modern database like MongoDB, offers greater flexibility and adaptability than traditional legacy systems.

If you’d like to learn more about how MongoDB can optimize your core banking functionalities, take a look at our white paper: Componentized Core Banking: The next generation of composable banking processes built upon MongoDB.