Building a fast, simple, and flexible way to make payments and offer credit to 12 million registered users

slice, which has emerged as a leading innovator in India’s fintech ecosystem, calls itself a zillennial product built by the zillennials. Zillennials being a term for the demographic group born towards the end of the time period for millennials and beginning of the generation-z time period.

The company believes that personalization combined with an extreme focus on superior customer service is the key to building long-lasting relations with young people. Not surprising then that the company’s singular focus is on providing the best consumer payments experience in the world, according to Upendra Kumar Singh, Head of Engineering, slice.

Speaking at the December 2022 MongoDB Day at Bangalore, Upendra described how slice is leading the disruption and innovation in the fintech ecosystem and setting global benchmarks.

The company has more than 12 million registered users on its platform. The slice app provides a fast, simple, and flexible way for users to make payments and avail of credit. For the vast majority of Indians, getting credit is typically challenging due to stringent regulations and lack of credit data. Through the use of modern underwriting systems, slice is helping broaden the accessibility to credit in India. The company is among the top pre-paid card providers in the South Asian market.

The challenge

Providing a seamless credit experience for customers by transforming the ‘Know Your Customer’ (KYC) process

slice found itself compared to other fintech apps which were typically ready to use immediately after downloading. They didn’t require users to fill out forms or wait for approvals. Since slice offers a credit product, the process of determining worthiness requires that they match several variables to ascertain the creditworthiness of the user. They would run a reverse look-up process matching the profile of the user to a network of other users to estimate likelihood of default.

This process was manual and quite time-consuming, which meant that users needed to wait 24 to 48 hours for the completion of the credit underwriting process. This was inconvenient, especially in scenarios such as flash sales or medical issues where users require credit immediately.

The other problem was dynamic spikes in traffic which could bring down the entire infrastructure and, therefore, the whole service.

“The team needed the infrastructure to scale seamlessly through a dynamic scaling capability. We also needed the ability to preschedule clusters for scaling when high volumes were anticipated such as in the event of marketing campaigns or monthly billing cycles,” said Upendra Kumar Singh, Hhead of Engineering, slice.

The team was also keen to free up time from managing databases to be able to focus on building features that would add value for customers.

The solution

Real-time computation of more than 100 variables to determine creditworthiness in minimal time

From early on MongoDB was one of the core databases the company used in order to take advantage of its flexible schema and speed of development. However, at first the development team self-managed the database. Then as the scale grew, they found there were often dynamic spikes which would threaten to bring down the application and cause an outage. The team realized the need for dynamic scaling capabilities and moved to MongoDB Atlas.

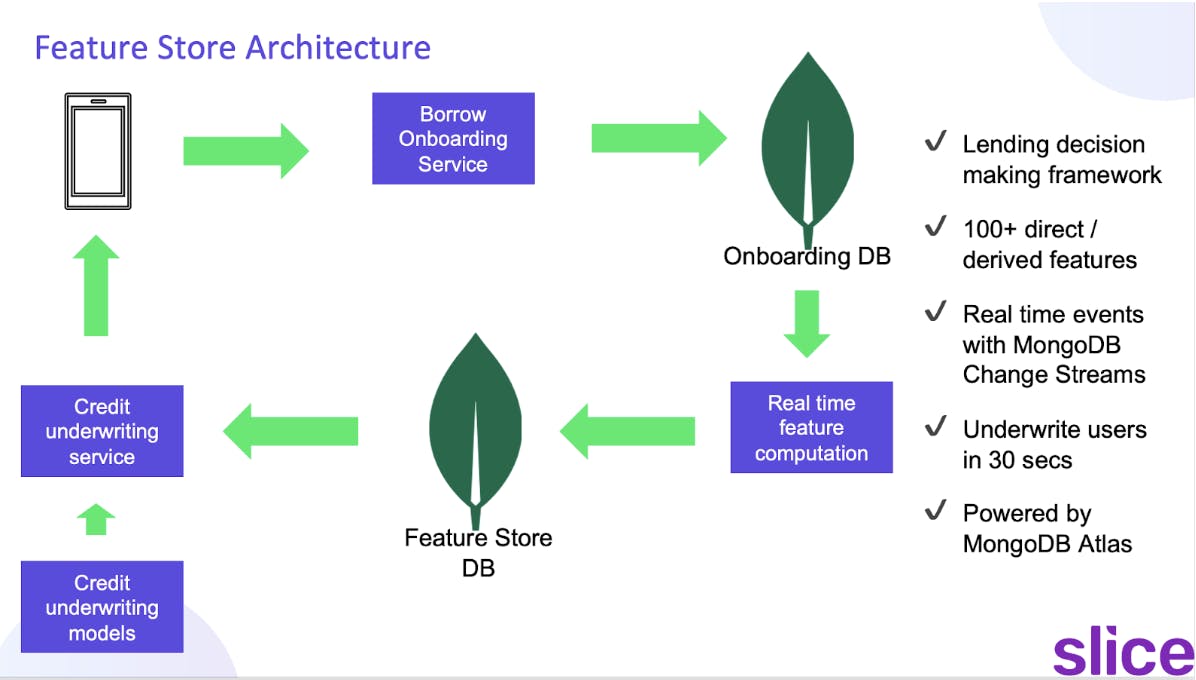

slice uses MongoDB Atlas for a number of use cases. One example highlighted in slice’s MongoDB Day presentation was a use case called real time feature store. The slice team took on the challenge of making the onboarding process for credit users more smooth and quick. Code named ‘Project Makhan’ (Makhan means butter in Hindi), the objective was to reduce processing time to less than a minute. To achieve this, the team used Change Streams in MongoDB Atlas to evaluate the user information in real-time.

“As and when the user filled out the application with details such as name and gender, we used the Real-time feature store with MongoDB and ML models to compute 100+ direct and indirect variables in real-time to determine if the user was eligible for credit,” said Upendra Kumar Singh, Head of Engineering, slice.

When users start filling out details using the mobile app, this information is stored in Atlas and computation starts with derived variables. Once all the variables are computed, an AWS step function is triggered. In turn, this triggers the credit underwriting service, which takes all the computed variables and feeds them into the ML model. The model determines the user’s score between 0 and 100. A rules engine looks out for red flags. The red flags are analyzed using MongoDB to determine the likelihood of the user being a defaulter.

This was a manual process, but with MongoDB Atlas, the resolution of red flags happens automatically in real-time. The decision is then communicated to the user.

Currently, MongoDB supports 15+ clusters with 17.5 TB data, which is used by more than 12 million registered users. slice can carry out about 15,000 MongoDB input/output operations per second (IOPS) during peak hours.

With the auto-scaling capabilities, the team can add or remove nodes on demand using Atlas cluster APIs. Given that the functionalities can often be used for critical workloads in emergency situations, uptime was important.

The result

Unprecedented processing speed and 99.995% uptime for more than 12 million registered users

“The solution enables credit underwriting decisions to be taken in under 30 seconds by calculating more than 100 user variables in real-time. This solution triggered exponential growth of slice as no other player in the industry was providing credit in 30 seconds. With MongoDB’s resilient distributed architecture, slice can achieve a 99.995% uptime SLA. There have been no outages except for those due to manual errors,” said Upendra Kumar Singh, Head of Engineering, slice.

MongoDB Atlas provides the core capabilities that slice requires to dynamically scale their business, including the flexibility of the document model, Change Streams, always-on security, continuous backup, easy migrations, real time analytics and native tooling.